Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review

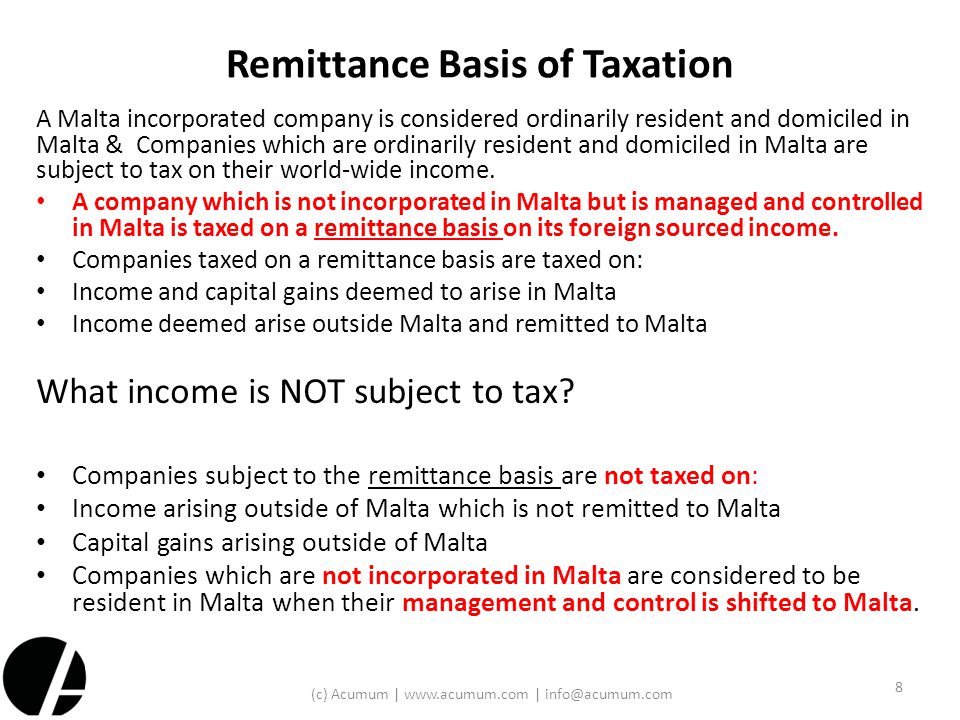

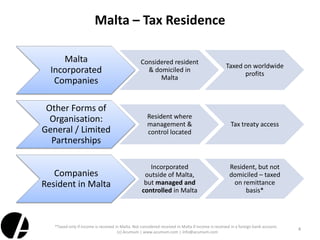

Fenech & Fenech Advocates - Malta - Malta operates a remittance basis of taxation for persons who are resident or domiciled in Malta for tax purposes. The Budget Implementation Act (Act VII

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review