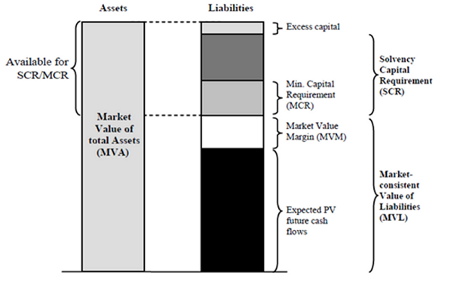

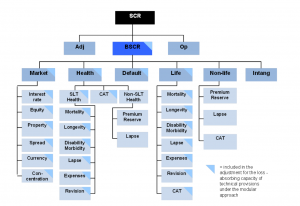

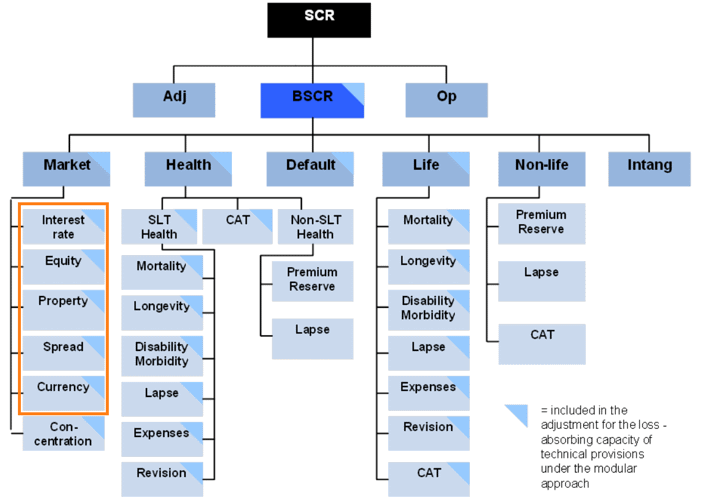

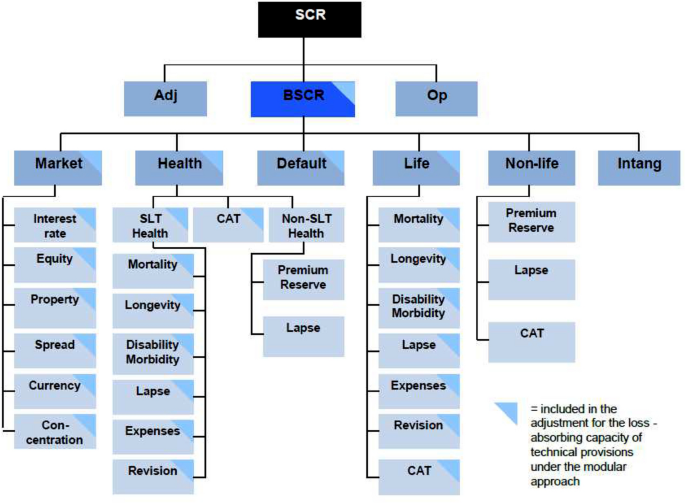

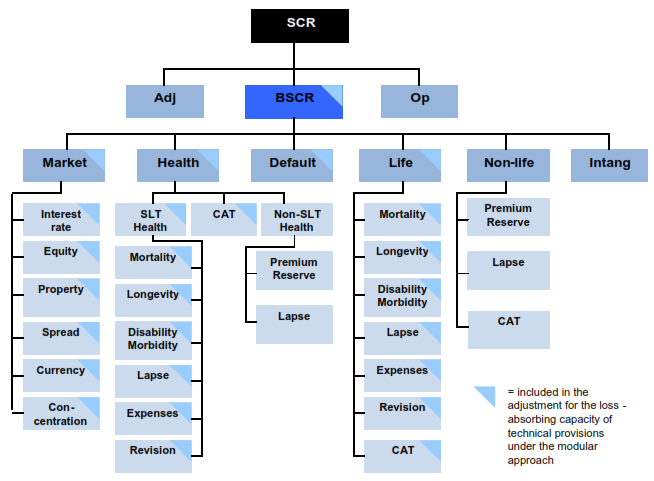

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

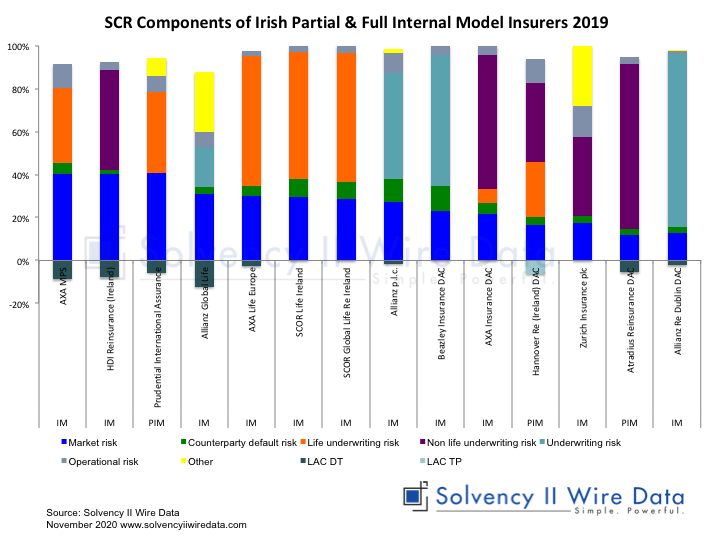

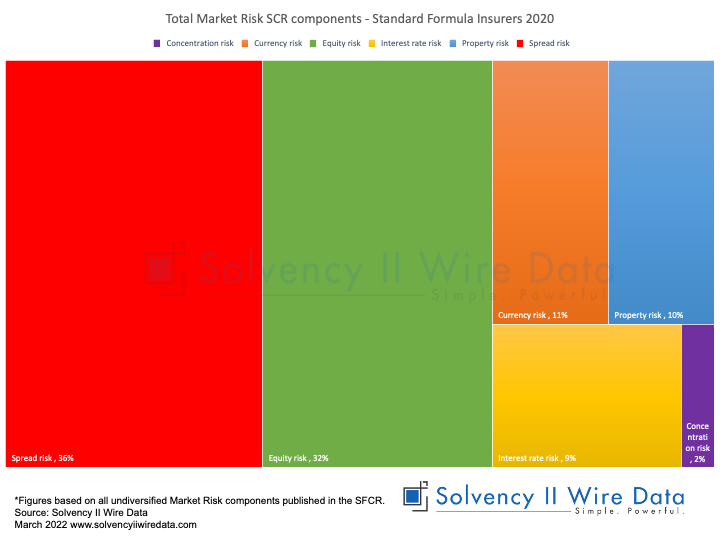

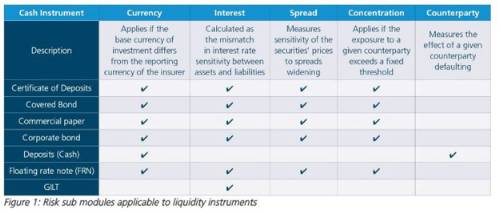

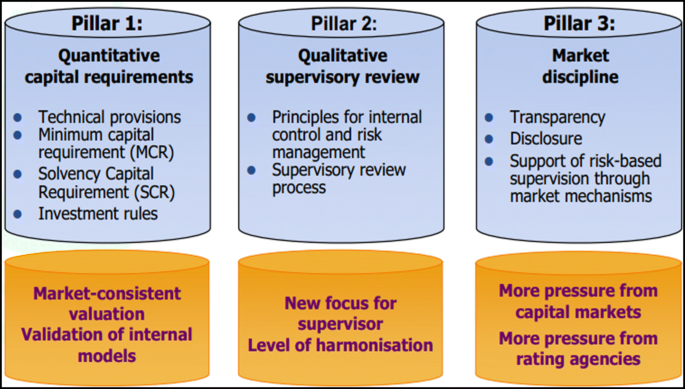

Measuring market and credit risk under Solvency II: evaluation of the standard technique versus internal models for stock and bond markets | SpringerLink

Quantifying credit and market risk under Solvency II: Standard approach versus internal model - ScienceDirect