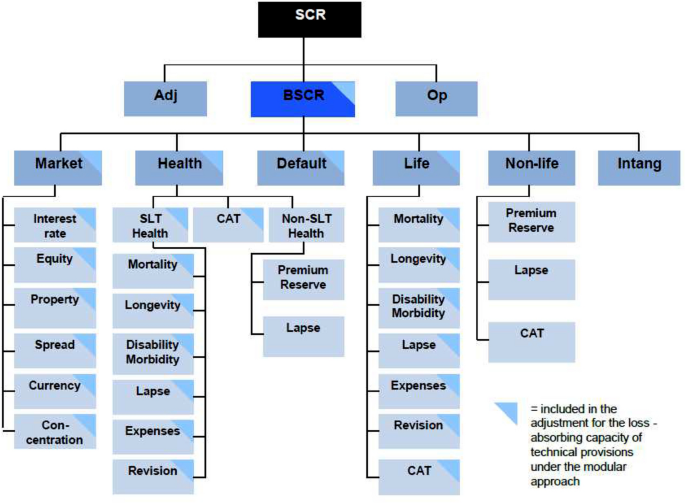

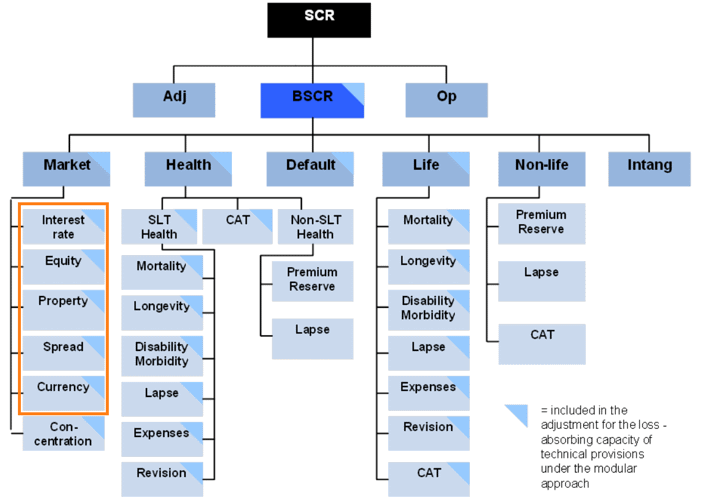

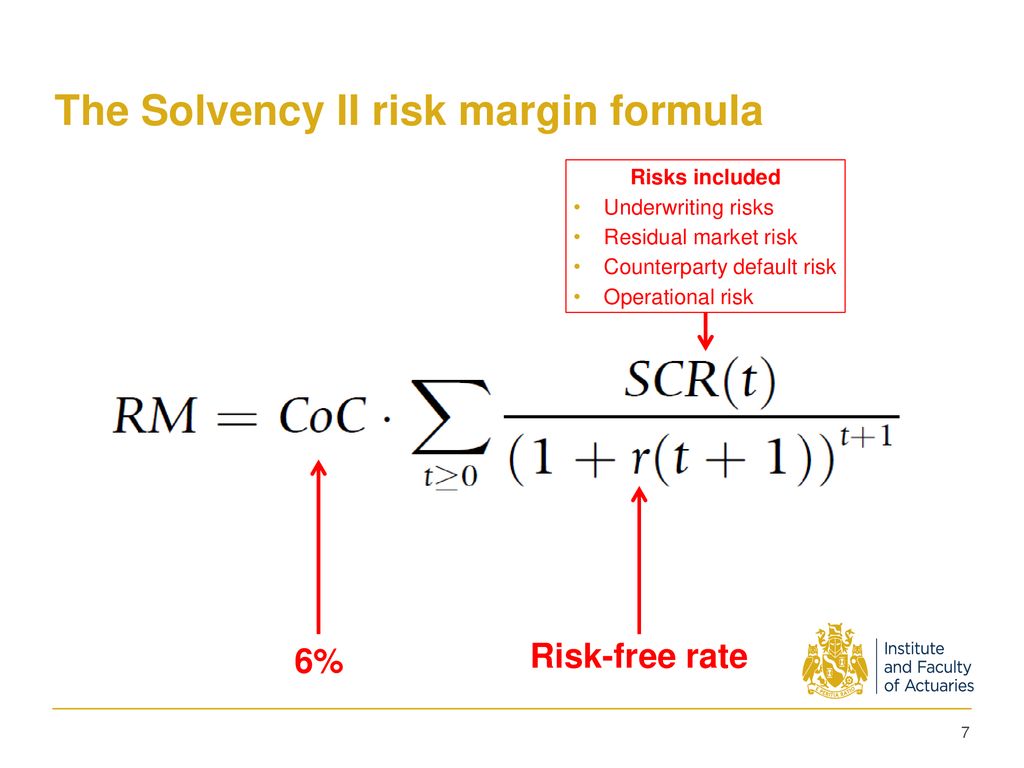

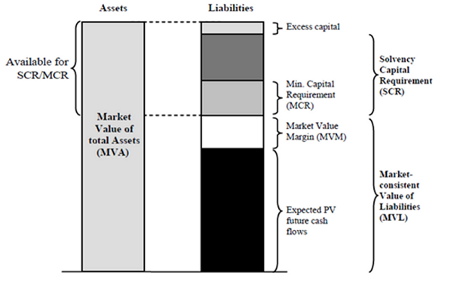

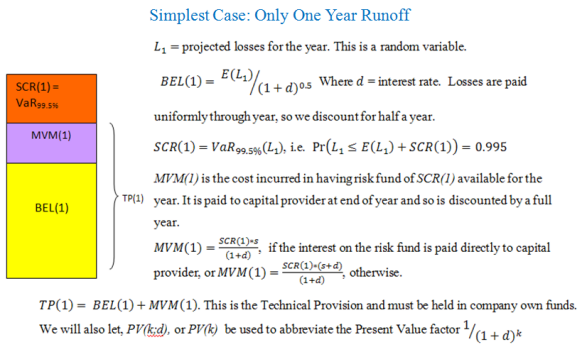

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

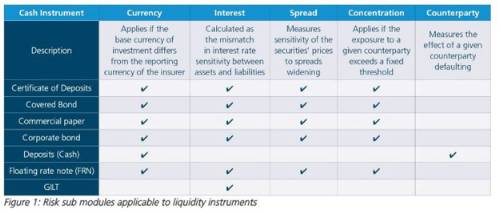

Article 178 Spread risk on securitisation positions: calculation of the capital requirement | Regulation 2015/35/EU - Solvency II Delegated Regulation | Better Regulation

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar